Quarterly Update – July 2023

Excellent Quarter To Enjoy The Fruits Of Equity Investing!!

When we wrote the last quarterly update in April 2023, there was a sense of despair & irritation among the investors after a lackluster 18 months, starting October 2021. The market was then stuck in a narrow range between 16k to 17.5k on the Nifty and tested the patience and conviction of investors.

We believed that the markets would recover and post better returns in the coming months and years by listing probable triggers for a rally in the Indian indices. You can read our April update here (https://marinawealth.com/quarterly-update-april-2023/)

Post that quarterly update, in the Financial Year 2023-24 starting 01st April 2023, the markets have rallied as below:

| Nifty 50 | 15% |

| Nifty Mid Cap | 22% |

| Nifty Small Cap | 27% |

One of the points mentioned in that is “Flows from Foreign Institutional Investors (FIIs) are improving slowly but steadily”. The floodgates got opened in April 2023 and the last 4 months, FPIs have been very generous in allocating money towards Indian equities.

FPI flows in the last 4 months:

| April 2023 | 11,631 crores |

| May 2023 | 43,838 crores |

| June 2023 | 47,148 crores |

| July 2023 | 39,165 crores |

As we write this quarterly update, we are seeing all-round improvement in our client portfolios with majority of them showing returns of mid to high teens on their equity funds.

As humans, we are wired to constantly worry, both when things go well or not going well.

Now, the question in everybody’s mind is it the right time to book profits?

To answer that burning question of profit booking, we would like to see how the valuations look like? Is it excessive or is it still in a reasonable zone. The valuations are usually measured by the P/E ratio (Price divided by the Earnings) driven the Earnings of the companies (E) and how many times the forward earnings it is trading (P).

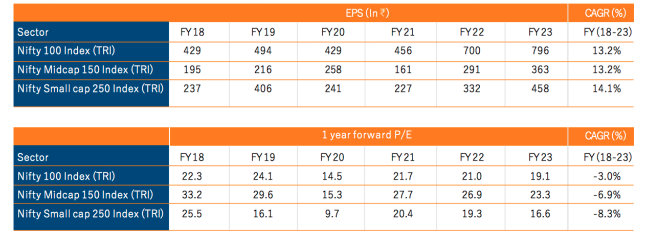

To give you a perspective of the same, the below table summarizes it very well.

Snapshot of Earnings Growth Across Market Capitalisation and 1 Year Forward P/E

Source: Bloomberg as provided by Mirae Asset MF

The above table will help you understand that the rally in indices is led by earnings growth. The earnings growth has remained robust even during the Covid years and looks promising with the valuations looking not stretched at all.

As per our own analysis and from the various external valuation metrics as above, we feel that we are not in a bubble zone to worry about. Having said that, there will be intermittent profit booking by various market participants which will throw opportunities for the long term.

Investing requires looking far into the future. When we look into the future, you will see the Indian economy enjoys some big advantages as listed below:

- Demographic advantage – India today is very youthful! More than 45% of the population is less than 29 years of age. It provides enormous opportunities as supplier of human capital to the world at large and also drives the domestic consumption.

- Capital investments by the government – The Central Government is focusing on capital asset creation by spending almost 10% of budgetary allocations towards that. The investments in infrastructure development will help to trigger economic activity and keep them buzzing for

years to come. - Focus on gaining global manufacturing market share – With the world moving away from China as the global supplier and looking for alternatives, India stands a fair chance of grabbing manufacturing market share and become supplier to various countries. Production Linked

Incentive scheme across 14 different industries gives more thrust to manufacturing. - Indigenization – With the Government focused on reducing external dependency on areas like Electronics and Defence equipment, it has created a tailwind for manufacturing led growth.

Overall, though the recent market movements will look exaggerated on the margins, the actual fact is that the economy is doing reasonably well. India is the fastest growing large economy and there is no reason at this moment that looks to be shaken. We will suggest you to remain positive on Indian economy over the long term and reap the benefits by participating in the India businesses.