Quarterly Update – April 2023

It’s time to sow!

“To be a successful investor, you have to have a philosophy and process you believe in and can stick to, even under pressure.” Howard Marks

We are writing to you when almost all the investors are going through a pressure situation and are being tested on their philosophy and process. We have seen negative or low single digit returns over the last 18 months or so. For investors who have started their investments in middle to late 2021 and beyond, their conviction is getting severely tested.

This naturally leads us to the next set of logical questions like:

- Are we doing the right thing now by investing in equities?

- Why after 18 months am not even making FD kind of returns?

- Whether the funds chosen are the right ones?

- Is it really worth investing in equities at all?

We understand the sentiments and completely empathize with you.

First, let’s understand what caused this dull phase in the equity markets?

- Ongoing Russia – Ukraine war

- Volatility in global commodity prices

- Resulting inflation due to high commodity prices and supply chain issues

- Central Bank actions of rising interest rates to tame inflation

- Risk off mode across the globe by institutional investors

The markets are stuck in a range over the last 18 months. The Sensex reached 60k on 16th October 2021 and today we are around 58k on the Sensex. So, for more than 18 months the broader market hasn’t moved neither up nor down. In this scenario, the funds in which you have invested also has struggled due to lack of tailwinds provided by the broad market direction.

Look at the Nifty movement chart over the last 18 months below:

Okay, now tell me what happens next is the question in your mind, right?

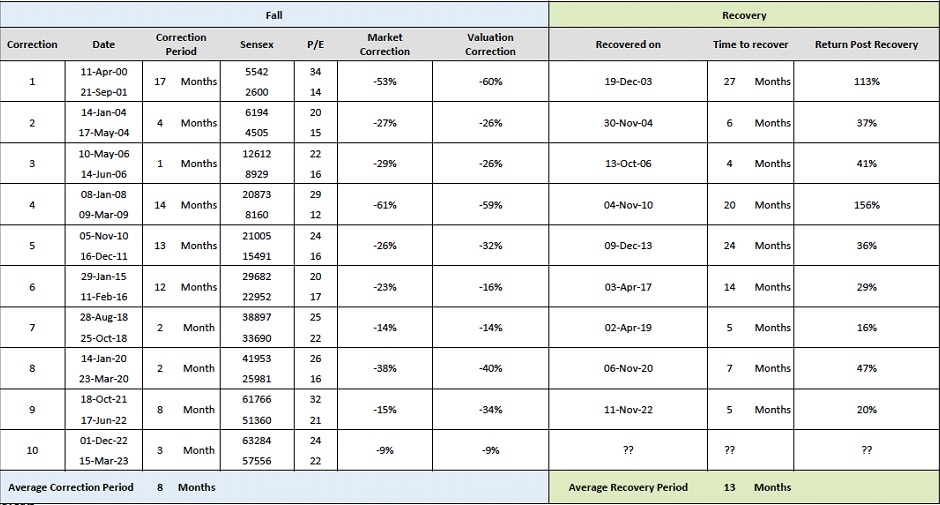

We have seen from the past market movements, every dull phase is followed by a bright phase. Over the last 23 years or so, we have seen at least 10 market corrections ranging from 9% to 61% fall. The markets have recovered and crossed the previous highs in 9 of those occasions. The average time taken for the recovery is 13 months.

We are now waiting for the 10th correction to get over and cross the previous highs.

Why we are saying that the markets may recover?

- Market valuations have become attractive compared to what it was in October 2021

- Global Commodity prices have cooled off

- Result is the slow uptick or cool down in the inflation over the next few months

- Central Bank rate hike cycle is peaking and may not have drastic rate hikes in the coming year

- Flows from Foreign Institutional investors (FIIs) are improving slowly but steadily

As someone who have been interacting with hundreds of investors over the last decade or more and having witnessed ourselves few equity market cycles, we can assure that going through a dull phase in equity markets is part of every investor’s journey. Nobody can escape from it.

To conclude,

- Ignore the short term returns and don’t get influenced by it. We can’t predict when the tide will turn

- Keep a tab on your asset allocation. If there is an opportunity, we should add money in equities.

- Continue with your SIPs though they are not providing any decent returns as of now, but it will eventually.

There is a saying with regard to farming. There is a season to sow and you need to wait for the right season to reap. This is the season to sow!! Need to wait for the right season to reap the harvest.

We are in the process of completing our half-yearly fund selection review and we will get back to you if we see any opportunity to realign the portfolios through fund changes in the next 1-2 months.

“You make most of your money in a bear market, you just don’t realize it at the time” – Shelby Cullom Davis