Union Budget – An act of Fine Balance, as Government tries to shift focus from Capex to Consumption!

Though the importance of the budget for taking investment decisions has come down over the years, it gives us insights into the Government’s thought process with regard to financial management. This budget has tried to achieve a fine balance in managing these three different dimensions simultaneously :

- Increase Capital expenditure for long term growth

- Propelling near term growth through tax cuts to spur consumption

- Maintaining the fiscal discipline in terms of government expenditure

1. Capital Expenditure creates long term assets and also generates considerable employment opportunities in the economy.

- This Government has been focused on improving the quality of government spending, with capex accounting for nearly 25% of the total budgetary spends, a two decade high!

- This budget has provided for Capital Expenditure to the tune of Rupees 11 lakh crores.Compared to the previous years, the rate of growth for Capital Expenditure has seen a slight moderation.

- The capital expenditure has seen a 4 fold increase over the last 8 years. Just for comparison purposes, the capex for 2016-17 was 2.8 lakh crores.

Stocks in Industrial and Capital Goods segment- The last couple of years have seen a dream run in the share prices of companies in cyclical, government capex driven segments like Railways, Roads, Defence, Industrial and Capital Goods etc. While the status quo on capital expenditure is being maintained, the narrative has changed resulting in such stocks getting derated recently. Any further growth in these segments may be very stock specific.

2. Propelling near term growth through tax breaks to spur consumption in the economy To start off, lets congratulate ourselves for the tax breaks we all have got

- Increasing the income tax rebates has meant that tax filers with an income up to Rs12 lakhs need not pay any income tax at all under the new tax regime (NTR)!

- This is a very positive development for the middle class, which has gone through tough times in the recent years thanks to stagnating income and rising inflation.

- On an average investors may save between Rs50k to Rs1.10 lakhs a year.

- This will leave additional funds to the tune of Rs1 lakh crores in the hands of the consumers who may decide to save or spend. Assuming that at least 50% gets spent, it is expected to have a multiplier effect on the economy through consumption led growth.

- This tax cuts may also improve the compliance and disclosure of income leading to more formalization of the economy.

Stocks in the Consumption driven segments – The cut in income tax along with the various state government welfare schemes will leave more money in the hands of the consumer from the bottom of the pyramid to the middle class. The expectation is that both consumer discretionary (like travel,

tourism, leisure, electronics, automobile, white goods) and consumer staples (FMCG, Grocery Retailing, Tobacco etc.) segments will benefit from these additional spends.

It is important to highlight that the consumption stocks have not participated in the market rally of 2023/2024.

3. Fiscal prudence – provides stability to the economy in form of stable currency movements and lower borrowing costs for everyone. This budget has given specific guidelines and targets to meet by 2031.

- The budget estimates the fiscal deficit for FY26 at 4.4% compared to 4.8% for FY 25.

- Though our fiscal deficit has slipped post-covid years (It reached as low as 3.5% pre covid), we are relatively in a much better position compared to other major economies

- The government has also given a commitment for reduction of the fiscal deficit and a roadmap for monitoring till 2031 which is very positive

Prudent fiscal management gives ample ammunition to the Government if there are any challenges in the near term (e.g. tariff wars).

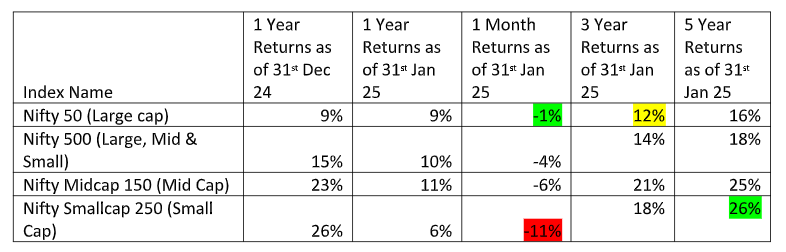

(Data as of 31 st Jan 2025. Source: NSE India)

A detailed analysis of the above table throws some interesting interpretations:

- In down markets, Large caps provide stability

In the last one month small cap stocks have fallen 11%. However, large caps fell only 1%. This is not the time to ignore the large caps even if their long term returns are lower ! - Short term returns can change very quickly

With the fall in small caps in 1 month, the 1 year returns of small caps fell to 6% (same 1 year return was showing 26% as of 31st Dec’24). Choosing the right fund manager is the most important thing in Small cap investing! - Wealth creation happens over the long term

The 3 and 5 year returns are very positive across market cap segments even after a tough 4 month period.

It is important to re-iterate the point that staying the course is very important to generate wealth.

What should we be doing as Investors?

- Invest more during down turns to take advantage – We have been passive in asking for fresh investments from you, but this may be a good time to start adding money to your portfolio. A lot of investors have been on the sidelines in the last two years, awaiting a downturn. This is the opportunity to build long term portfolios gradually

- Continue to keep your risk appetite and asset allocation in mind – While we would want you to invest in equity funds for the long term, always remember asset allocation and your long term goals.

- Don’t chase the recent winners – Instead of chasing the last year winners (which changes quickly as the above table shows), focus on building a diversified portfolio across investment styles and market caps. The secret is to hold on to them!

What we should NOT be doing as Investors?

- Stopping the SIPs – The last 1 year SIP returns have started turning negative. As we mentioned earlier, this is a great time to build portfolios and the worst mistake is to stop SIPs. Please don’t stop SIPs! (This is very important for new investors)

- Keep checking portfolios frequently and evaluating the short term returns –To enjoy good long term returns, we have to endure the intermittent volatility and down turns. Avoid checking returns on a daily basis!

- Buy every thematic fund which is being launched – the MF industry launched over 100 thematic schemes in 2024. We have been diligent in evaluating them and not suggesting anything of these new ones for you to invest in. Chasing every new fund offer is a loser’s game.

We would like to end this note with a quote from Joel Greenblatt, the legendary investor

“Unless you buy a stock(fund) at the exact bottom (which is next to impossible), you will be down at some point after you make every investment. Your success entirely depends on how dispassionate you are towards short term stock price fluctuations. Behaviour matters”